Content

For example, public accountants are busy during tax season, whereas private accountants are busier at the end of a fiscal quarter. Public accounting refers to providing a collection of financial or accounting services to one or more clients. Precisely, such services include preparing financial statements, auditing the statements, filing tax returns, advising on mergers and acquisitions, and so on.

Her expertise covers a wide range of accounting, corporate finance, taxes, lending, and personal finance areas. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

Tax Accounting Businesses

In their new position they are referred to as a private accountant, corporate accountant or internal accountant. The main difference between private and public accountants is their job duties. Public accountants spend their days reviewing financial documents for accuracy and completeness before they are disclosed to the public. They test and analyze the financial records their clients submit for errors.

- Research the education requirements, licensure information and experience…

- Private and public accountants will both face a busy season during the year.

- To join the ranks of public accountants, the minimum education is a bachelor’s degree in accounting.

- The person who is concerned with maintaining the accounts of any organization is referred to as ‘Accountant’.

- The term „document“ is synonymous in meaning and equal in scope to its usage in Federal Rule of Civil Procedure 34, including, without limitation, electronic or computerized data compilations.

Those entities do not themselves perform external professional services, nor do they own or control the member firms. Nevertheless, these networks colloquially are referred to as „firms“ for the sake of simplicity and to reduce confusion with lay-people. These accounting and what is public accounting professional services networks are similar in nature to how law firm networks in the legal profession work. The U.S. Bureau of Labor Statistics projected employment growth for all types of accountants, including public accountants, to rise by 4% between 2019 and 2029.

Successful Online Learning Strategies: The Importance of Time Management for Students

However, Ernst & Young told the inquiry that the dinners, which were held once or twice a year, were to discuss industry trends and issues of corporate culture such as inclusion and diversity. None of the „firms“ within the Big Four is actually a single firm; rather, they are professional services networks. Each is a network of firms, owned and managed independently, which have entered into agreements with the other member firms in the network to share a common name, brand, intellectual property, and quality standards. Each network has established a global entity to co-ordinate the activities of the network. I would encourage students starting out in accounting to spend some time investigating their career options and talk to other people in the industry to get a sense of the best career fit for them. As a CPA, it’s very rewarding to be able to make a direct and positive impact on a business client, especially with a not-for-profit that makes a real difference in our community. I also really enjoy the client education aspect of my work when I can help client accounting team members learn additional skills or be a resource to answer questions and resolve problems.

The company was indicted for obstruction of justice for shredding documents related to the audit of Enron. The resulting conviction, although later overturned, doomed Arthur Andersen, because most clients dropped the firm, and the company was not allowed to take on new clients while they were under investigation.

Find a legal form in minutes

As such, CPAs are often accountants that perform the same duties and functions as an accountant without the designation. These include performing audits of public U.S. companies and preparing audited financial statements for a company, such as a balance sheet or an income statement. A certified public accountant is a designation provided to licensed accounting professionals. The American Institute of Certified Public Accountants provides resources on obtaining the license. The CPA designation helps enforce professional standards in the accounting industry. Each Big Four company will have a diverse staff armed with varying level of expertise to meet their client’s needs. In general, Big Four firms all provide audit, assurance, consulting, financial advisory, risk management, and tax compliance services.

- Many of these accounting firms frequently recruit from our Accountancy program, often coming to campus during the peak of fall recruiting season.

- It’s been really interesting to see accounting from another perspective as part of an internal accounting team.

- No business functions without getting involved in monetary transactions; and in order to keep track of the transactions for analysis, they indulge in maintaining a record of it.

- Let us know what type of degree you’re looking into, and we’ll find a list of the best programs to get you there.

- They work with financial managers to plan budgets, evaluate fiscal performance, and ensure that correct financial practices are being followed.

The work environment for private accountants usually features no travel and a fixed work schedule and location. For these reasons, private accounting is often considered the more stable choice for day-to-day work. Senior Auditor (3-6 years) works under the general direction of an Audit Manager. Responsibilities include the direction of audit field work, assignment of detail work to Staff, and review of their working papers. Also prepares financial statements, develops corporate tax returns, and suggests improvements to internal controls.

Earn your Accounting Degree. 100% Online.

In October 2018, the CMA announced it would launch a detailed study of the Big Four’s dominance of the audit sector. Audited means a third party has reviewed the financial statements and can state that they were prepared the proper way using Generally Accepted Accounting Procedures , and that the numbers on them are accurate. The business has reached the stage in their growth where they need yearly audits of their financial statements because investors and bankers require them.

- The Enron collapse and ensuing investigation prompted scrutiny of the company’s financial reporting and its long time auditor, Arthur Andersen.

- These are some of the pros and cons to consider if you want to pursue private accounting.

- You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

- Tax accounting firms focus on tax preparation and planning for companies of all sizes, and also for individuals.

- It won’t be wrong to say that no business can survive without maintaining the accounts.

- While many jobs in accounting involve long work hours, corporate and public accountants approach work-life balance differently.

- In private accounting, you can start in an entry-level position and move through different positions like as an auditor, accounting manager, financial director, and up to a Chief Financial Officer position.

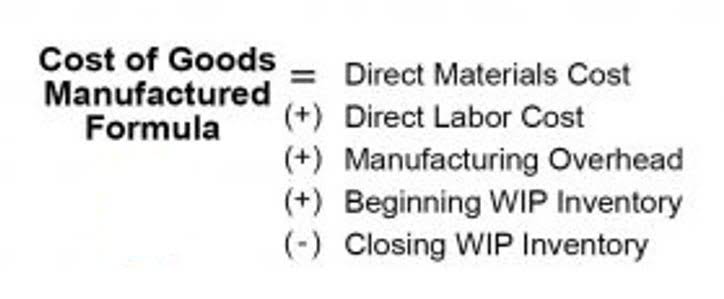

A master’s degree in accounting is ideal for professionals who want to specialize in accounting and finance, while an MBA can help accountants gain cross-functional leadership skills. Public accounting firmmeans a sole proprietorship, partnership, corporation or other legal entity engaged in the business of providing services as public accountants. Depending on the type of accounting you want to https://www.bookstime.com/ pursue, both careers can be rewarding. You have an opportunity to use your analytical and critical thinking skills in both roles, along with data analysis and budgeting. While public accountants will deal with audits, private accountants might deal more with payroll, invoicing and accounts payable. For both public and private accounting, a bachelor’s degree in accounting is the main requirement.

Public accountants and public accounting firms are not employed solely by any one client, and as such they are not part of the client’s business or corporate structure. Private accountants, on the other hand, work for the specific company or business entity for which they offer accounting services.

How many public accounting firms are there in the US?

In public accounting, the CPA serves many clients as an objective outsider or in an advisory capacity. Currently there are over 46,000 public accounting firms in the United States ranging in size from small local accounting practice to large international CPA firm.