Maßgebend für die zu verwendenden Reifen sind hauptsächlich der Durchmesser und die Breite der Felge.

-

Der Felgendurchmesser wird zwischen den Felgenschultern ermittelt. Er entspricht dem Innendurchmesser des zu verwendenden Reifens und wird in Zoll angegeben.

-

Die Felgenbreite wird zwischen den Felgenhörnern gemessen (dem Innenabstand) und auch als Maulweite bezeichnet.

Für die Montage der Felge am Fahrzeug sind die Lochzahl und der Lochkreis des Lochkranzes, der Durchmesser der Radnabenbohrung, und die Einpresstiefe entscheidend:

-

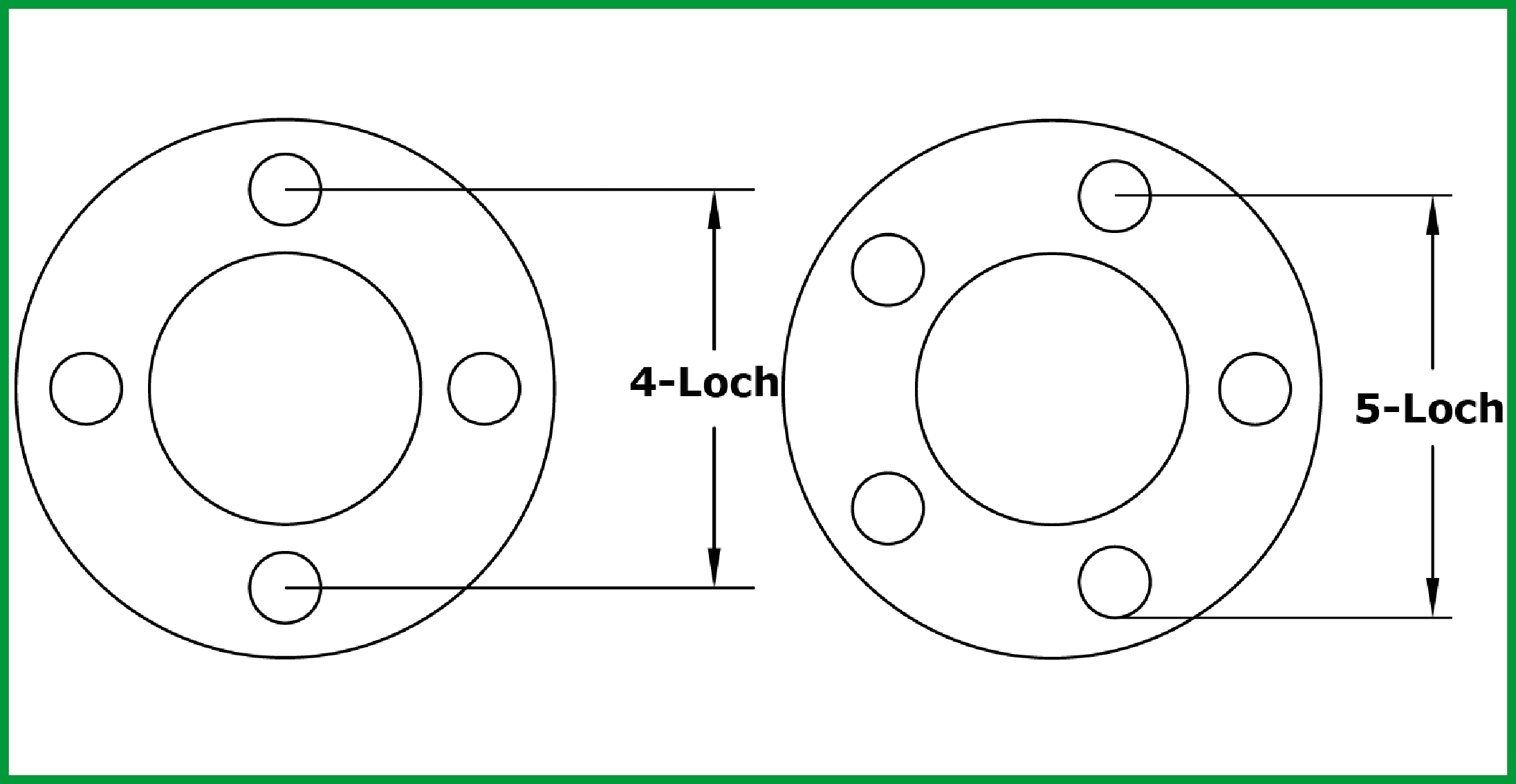

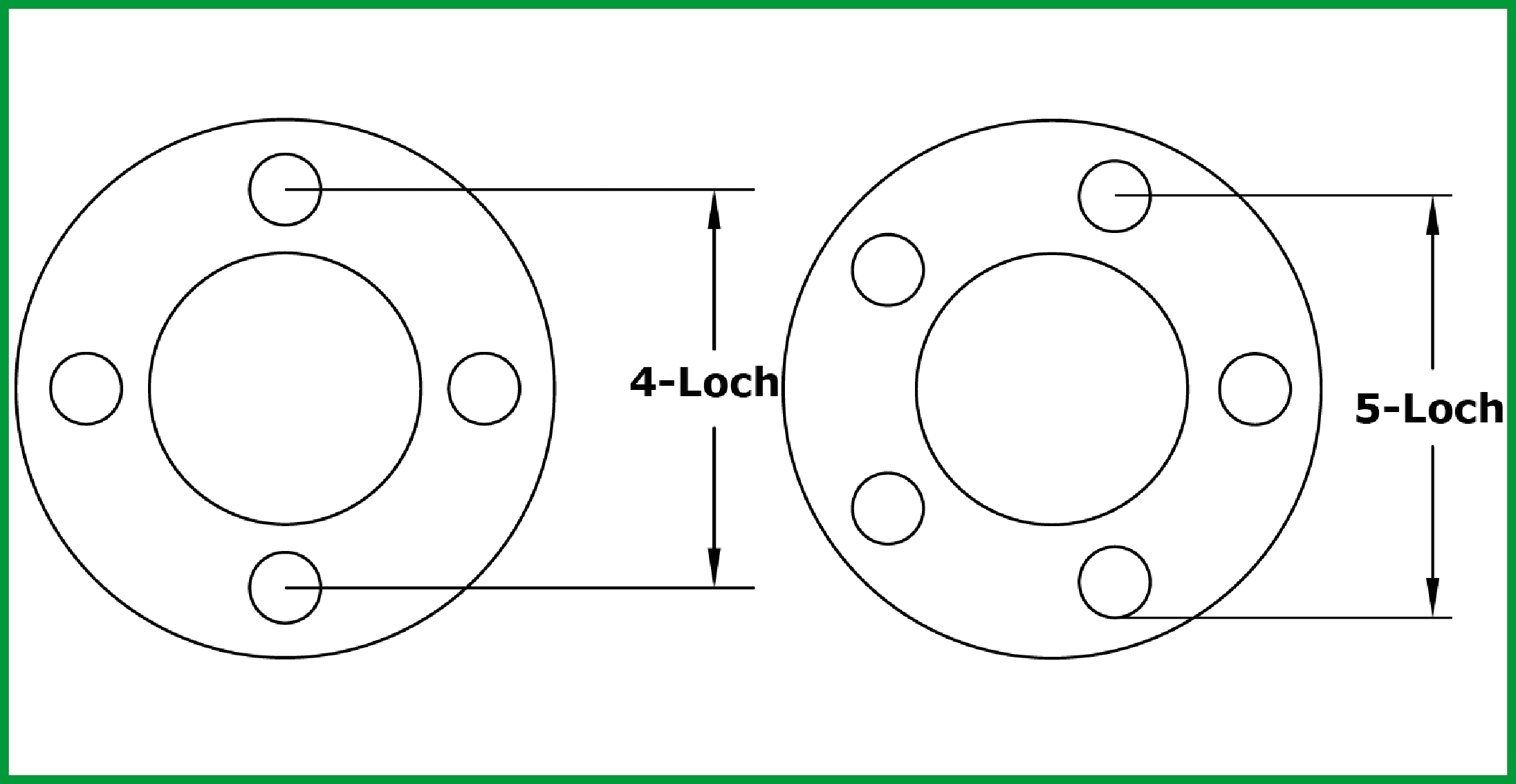

Die Zahl der Löcher, mit denen die Felge festgeschraubt wird, ist mindestens drei, üblicherweise jedoch vier oder fünf und bei Geländewagen oder Lastwagen mehr (Ausnahme: Zentralmutter wie beim Roadster im Bild weiter oben).

-

Der Lochkreis (LK) bezeichnet den Durchmesser in mm des Kreises, auf dem die Mittelpunkte der Schraubenlöcher liegen.

-

Die Mittenbohrung ist die mittige Bohrung, mit der die Felge auf den Radflansch aufgesteckt wird.

-

Die Einpresstiefe (ET) gibt die Abweichung zwischen der Radmitte und der inneren Anlagefläche der Radscheibe auf der Radnabe (genannt: Spiegel), also der Bremstrommel oder Bremsscheibe, an. Sie wird in mm angegeben. Ist die Einpresstiefe 0 mm, liegt das Rad in der Symmetrieebene des Reifens auf der Bremstrommel auf. Ist sie größer als 0, also eine positive ET, reicht das Rad weiter nach innen, das heißt die Spur (gemessen von Reifenmitte zu Reifenmitte) wird kleiner. Bei einer negativen ET wird die Spurweite vergrößert und das Rad wandert weiter nach außen.

-

Genaugenommen ist ebenfalls der Durchmesser der Löcher am Lochkreis entscheidend, so verwenden beispielsweise Mercedes-Benz und Volkswagen für ihre Transporter Felgen mit identischen Abmessungen, die Montageschrauben haben in einem Fall aber 12 mm, im anderen 14 mm Gewinde. Leichtmetallfelgen von Mercedes sind also auf VW-Transportern nicht verwendbar, da die Montageschrauben nicht durch die Löcher passen.

Beispiel einer PKW-Felgenbezeichnung:

Die Angabe bezeichnet also eine einteilige Tiefbettfelge mit Doppelhump, 7,5" Maulweite, 16" Durchmesser, einem Felgenhorn in J-Ausführung, einer positiven Einpresstiefe von 15 mm und 5 Befestigungslöchern auf einem Kreis mit 110 mm Durchmesser verteilt. Die Humpausführung lässt auf die Verwendbarkeit von schlauchlosen Reifen schließen, ist aber nicht zwingend.

Der Durchmesser des Mittelloches (Radnabenloch) und das Material gehen aus dieser Bezeichnung ebenso nicht hervor wie die Bolzenlochausführung für die Montageschrauben oder Radmuttern. Dies kann zu Irritationen führen (siehe oben).